On June 23,2021 Gujarati Midday a daily newspaper by Jagaran group has published my article on Critical Illness under Term Life Insurance as rider v/s Standalone Critical Illness Policy. The article image is here for the ones who can read Gujarati and translation of the same in English is after the image for the readers, clients, friends and family.

Last week we learnt about Critical Illness policy under health insurance basket. This week we shall learn about an alternate way of buying Critical Illness cover under a Term Life Policy and the comparative factors along with the Standalone Critical Illness Policy.

Critical Illness policy is a benefit-based policy which provides for a lumpsum payout at diagnosis and should be bought specially if one has a family history of critical illnesses like cancer, last stage kidney failure, end stage liver failure, CABG etc.

Critical Illness with a Term Life policy comes as a rider and can be opted by paying additional premium with term policy premium. The premium for CI remains constant through the policy term makes it a sweeter.

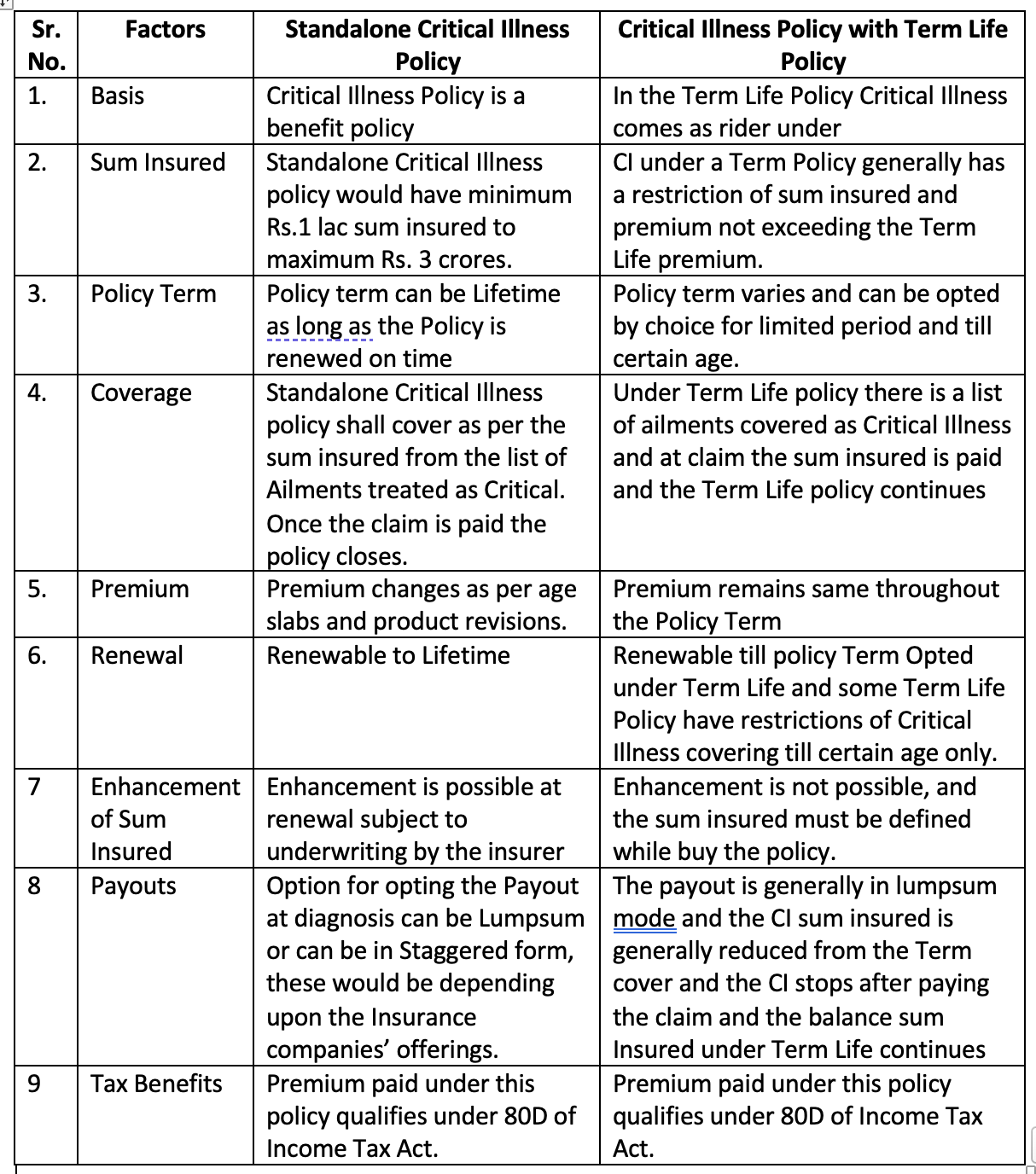

Following are the comparative factors to be considered before buying Critical Illness Policy:

Conclusions –

If you are yet to insure yourself under a Term Life Policy then make sure you include the rider of Critical Illness which is a good buy as premium remains the same through the policy term.