On May 19,2021 Gujarati Midday a daily newspaper by Jagaran group has published my article on Difference between Top Up Policy and Super Top Up Policy under Health Insurance. The article image is here for the ones who can read Gujarati and translation of the same in English is after the image for the readers, clients, friends and family.

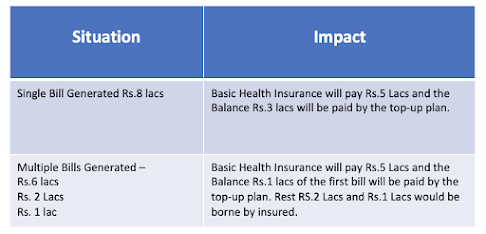

A top-up plan is a regular health insurance policy that covers hospitalization costs but only after a threshold limit (i.e. deductible), is crossed. It gives additional coverage, beyond the threshold limit of the existing health insurance policy in a single bill. The threshold limit can be met by a health insurance Policy or by self-funding also. However, it is not mandatory to have a base policy to buy a Top-Up Mediclaim Policy. The policy can be issued on Individual or Floater basis.

What is deductible?

• Deductible means the amount stated in the schedule which shall be borne by the insured in respect of each and every hospitalization claim incurred in the policy period.

• The company’s liability to make any payment for each and every claim under the policy is in excess of the deductible.

How is the deductible applied at the time of claim under Top Up Policy ?

• Deductible would be applied afresh for each claim.

• Each and every hospitalization would be considered as a separate claim.

• The limit of indemnity /Sum Insured is the maximum liability above the deductible.

Example – Basic health insurance policy of Rs. 5 lacs and Top-up plan of Rs. 10 lacs, with a threshold of Rs. 5 lacs.

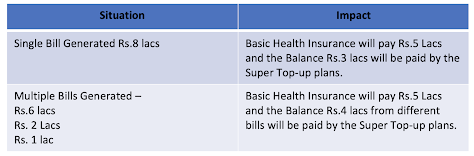

Super Top-up Policy :

A super top-up plan covers the total of all hospitalisation bills (up to the super top-up plan limit) above the deductible amount, that is, the deductible is applied to the total claims in a year. Hence, once the deductible is paid, the plan becomes active for subsequent claims. Similar to top-up plans, except that top-up plan covers a single claim above the threshold limit, while the super top-up plan covers the total of all hospitalization bills above the threshold limit.

Example – Basic health insurance policy of Rs. 5 lacs and Super Top-up plan of Rs. 10 lacs, with a threshold of Rs. 5 lacs.

So, while enhancing your health insurance, Super Top-up plans are the ideal way of doing it. Super Top-up plans are cost effective and best when clubbed with same insurance company as claim settlement becomes cashless under base + Super top up policy when getting treated at network hospital.

Q: Can one only buy a Super Top Up Policy?

A: Yes keeping in mind about the threshold(deductible) limit of the base policy or no policy allows you to buy only a Super Top Up Policy

Q: Which points are to be kept in mind while buying a Super Top Up Policy?

A: Features like – Financial limits and sub limits, Two Policies would mean two claims, waiting period, cashless network, buying both policy – base and super top up in the same month or preferably on the same date.

Q: Would waiting period on Pre existing disease be applied to a new Super Top Up Policy?

A: Yes there would be waiting period applicable as per policy terms and conditions.

Q: How much deductible one should avail from a Top-up or a Super Top Up policy?

A: Under Top-Up Plans minimum deductibles available from Rs.30000 to Rs.10 lacs whereas under Super Top-up Plans minimum deductible available is from Rs.1 lac to Rs. 40 lacs.

Generally, one should opt for deductible equivalent to your base health policy or even less than that so that while a claim arises the deductible triggers early and claim is settled.

While you opt for lesser deductible it would be a little expensive than the higher deductible.